massachusetts commercial real estate tax rates

Each year local assessors in every city and town in Massachusetts have a constitutional and statutory duty to assess all property at its full and fair cash value under Massachusetts General Law. The average residential tax rate for the county is 1423.

Massachusetts Property Tax Calculator Smartasset

Find All The Record Information You Need Here.

. The towns in Worcester County MA with the highest 2022 property tax rates are Bolton 1987 Lancaster 1945 and Sturbridge 1915. Real Estate Residential 995. They are expressed in dollars per 1000 of assessed value often referred to as mill rates.

Find County Online Property Taxes Info From 2021. A state excise tax. However some counties charge additional transfer taxes.

FY2021 Commercial Tax Rate. Tax rates in Massachusetts are determined by cities and towns. Excise tax vehicles varies per.

If so please use this Contact Form. NEW -- Massachusetts Property Tax Calculator. Ad Search Commercial Property by Property Type Location Price etc.

830 AM to 430 PM Monday through Friday. Source MLSPIN April 6 2022 View All Towns View by County. Massachusetts Property Tax Rates.

Real Estate Commercial 2664. Most surrounding suburbs are between about 9 and 14. Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor your citytown.

For example if your assessed value is 200000 and your tax rate is 10 your total annual tax would be 2000. This is called the 2½ levy ceiling. In all 18 communities hiked their.

The total tax levy remains the same. Subscribe to Mayor Fullers E-mail. The residential tax rate in Worcester is 1521.

2012 per thousand of assessed value. Compare Top Lenders Lowest Rates For Financing Your Commercial Property. Taxes might be in the commercial lease as a pass-through.

The basic transfer tax rate in Massachusetts is 228 per 500 of property value. As of each January 1st local assessors. Town of Hanover 550 Hanover Street Hanover MA 02339 7818265000 Statement on Community Inclusiveness Website Disclaimer Hours.

For the most up to date tax rates please visit the Commonwealth of Massachusetts. The median commercial property tax rate fell about five cents in 2018 to 1754 per 1000 of assessed value. Massachusetts Property and Excise Taxes.

372 rows The rate for residential and commercial property is based on the dollar amount per every 1000 in assessed value. Massachusetts voters passed the ballot initiative in 1980. A commercial tenants furniture fixtures and equipment FFE can be taxed as personal property.

Use of these options results in multiple tax rates for different property classes because they change the components used to calculate the rate ie the amount of the tax levy being paid by or the assessed valuation of the class. Motor Vehicle Excise Tax. A local option for cities or towns.

625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or before the 20th day following the close of the tax period. The average residential property tax rate for Worcester County is 1584. 104 of home value.

The law limits the amount of property taxes a city or town can raise in two ways. 351 rows 2022 Massachusetts Property Tax Rates. Do you have a question about property tax.

Cambridge 592 Medford 901 and Woburn 934 have the lowest property tax rates in the county. Residential property tax rates in cities and towns around Massachusetts continued to decline this year as commercial rates edged upward indicating that more communities are shifting the burden of. 411 Single or Split Tax Rate.

Choose The CRE Mortgage that Fits Your Business Needs. The Tax Rate is set by the Select Board. An owners property tax is based on the assessment which is the full and fair cash value of the property.

Ad Short or Long Term. Taxes might be in the commercial lease as a pass-through. The amount raised in property taxes can never be more than 2 ½ percent of the full cash value of all taxable property in a city or town.

Real Estate and Personal Property Tax. Data Analytics and Resources Bureau Tax Rates by Class Data current as of 08092022. For example in Barnstable County the combined state and county excise rate is 285 per 500.

The towns in Middlesex County MA with the highest 2022 residential property tax rates are Maynard 2052 Stow 1956 and Acton 1945. FY2020 Commercial Tax Rate 2484 per thousand of assessed value. Water Sewer Bill.

City of Newton 1000 Commonwealth Ave Newton Centre MA 02459. Counties in Massachusetts collect an average of 104 of a propertys assesed fair market value as property tax per year. Provided for informational purposes only - please refer to massgov or each towns municipal website for most accurate tax rate info.

To pay the tax you purchase excise stamps from the Registry of Deeds in the county where the property is sold. The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000. A state sales tax.

Ad Unsure Of The Value Of Your Property. Tax bills reflect. Meanwhile the median residential tax.

Bostons residential tax rate is 1088 21 cents higher than last year. 370 rows Massachusetts Property Tax Rates by Town. Tax amount varies by county.

Visit my blog to learn a bit more about real estate taxes. Massachusetts Property and Excise Taxes. Sealer of Weights Measures.

Ad Get a Commercial Real Estate Loan From The Top 7 Lenders. Under property tax classification. The three Worcester County towns with the lowest property taxes are Dudley 1170 Royalston 1221 and Oakham 1272.

Other cities and towns with big hikes in the commercial tax rate include Pittsfield Fall River and Wenham. An office building with a reception foyer wall paintings sculptures furniture can all be assessed and taxed as personal property. Quincy MA 02169 617 376-1000 Hours.

1995 per thousand of assessed value. Have a Property Tax Question. FY2022 Commercial Tax Rate.

The people of North Adams have the highest commercial tax rates at 4066 one of 20 communities with commercial tax rates over 30.

Investing Rental Property Calculator James Baldi Somerset Powerho Real Estate Investing Rental Property Rental Property Management Rental Property Investment

Massachusetts Single Family Homes Put Under Agreement Up In December Massachusetts Association Of Buyer Agents Real Estate Investment Property Real Estate Marketing

Massachusetts Real Estate Transfer Taxes An In Depth Guide

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Massachusetts State 2022 Taxes Forbes Advisor

This Flowchart Could Help You Decide Whether To Buy Or Rent A Home Renting Vs Buying Home Renting A House Rent Vs Buy

Rent Vs Buy Figure Out What Option Is Best For You

Tried Of The Norm Maba Massachusetts Offgridliving Realestate Massachusetts Association Of Buyer Agents In 2022 Buyers Agent Off Grid Living First Time Home Buyers

Real Estate Spring Market Home Selling Tips Spring Buying Your First Home

Pros And Cons Of Fha 203k Loan Free Business Card Design Fha 203k Loan Free Business Cards

Hypotec Is Here To Help Take Advantage Of Our 10 Years Experience To Find You Low Refi Rates And A R Real Estate Infographic Real Estate Advice Mortgage Tips

Pin On Best Of Well Kept Wallet

Massachusetts Property Tax Calculator Smartasset

2022 Property Taxes By State Report Propertyshark

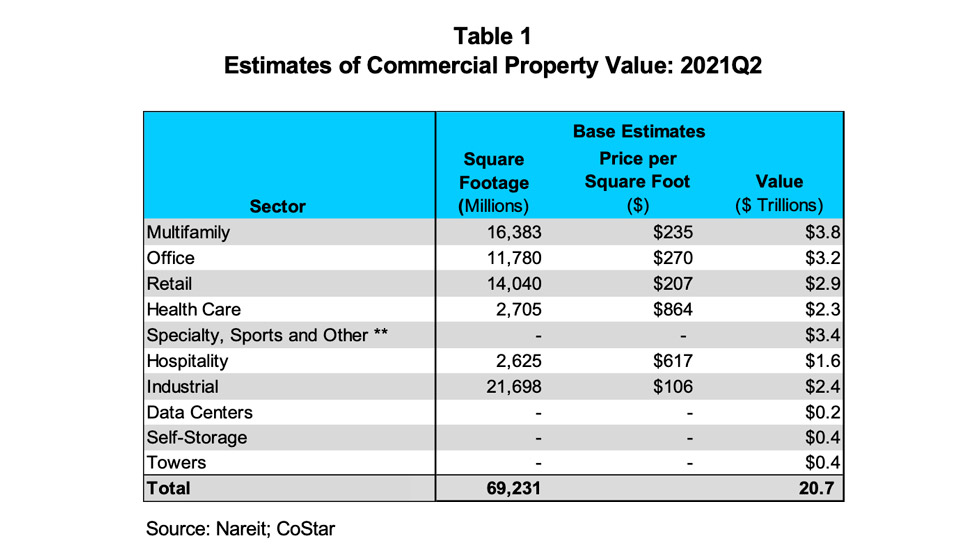

Estimating The Size Of The Commercial Real Estate Market Nareit

Most People Enter The Real Estate Market For Only One Reason Nbsp To Buy Or Sell A Primary Family Residen Being A Landlord Landlord Tenant Landlord Insurance

Yellow Letter Template Google Search Real Estate Marketing Plan Real Estate Postcards Real Estate Investor

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Glasbergen Cartoons By Randy Glasbergen For April 22 2015 Gocomics Com